Value Added Tax

1986/06/01 Jauregi, Mariaje - Elhuyar Fundazioa Iturria: Elhuyar aldizkaria

This tax reform has led to the disappearance of a set of taxes and fees. Among others, the following taxes: General Business Traffic Tax (IMD), Luxury Tax, Refreshing Drinks Tax, Telephone Use Tax and Internal Cargo Compensation Tax. On the other hand, from now on there will be products that until now did not pay taxes, such as primary articles, books, magazines, newspapers, cooperatives, houses of official protection, etc...

Reasons for tax reform

According to the Treaty of Rome, all EEA member states are required to apply a value added tax at all stages of the production process.

The Finance and Tax Commission of the EVD, created in 1986, under the presidency of Fritz Neumark, after analyzing the tax differences between the member states, presented a report. This report pointed to the need to eliminate cumulative multibody sales taxes, foreseeing instead the introduction into the tax system of Value Added Tax. Since then, it is a tribute to be applied in all States of the Community, with the aim of guaranteeing the free circulation of goods and services among all States of the EEC.

However, it is not an exclusive tribute to the EEC. It is also valid in countries such as Sweden, Austria, Norway, Argentina, Bolivia, Brazil, Mexico, Peru, Israel, Senegal, Morocco, etc.

In addition to not impeding free competition among Member States, there is another reason for the application of this tax. Again, the EVD, under the Treaty of Rome, has a budget for its operation, and the most important financial source of this budget is a percentage of States' VAT collection. It is therefore about securing a system that guarantees the income chapter of the European budget.

The initial contribution of each State could not exceed 1% of the collection for this tax. The maximum limit of the rate was 1%, being the limit respected in previous years. In 1979 the share was 0.78%, in 1981 0.89% and in 1983 0.99%. But this last year, specifically in 1983, this amount did not cover expenses and began to mention the need to review that 1%. Consequently, the budget deficit in 1984 raised the quota to 1.4%. Therefore, VAT has a major importance in the EC budget structure and, undoubtedly, the weight of VAT in the Association's finances is increasing.

So far they would be the international reason for tax reform, but other reasons are also mentioned at the state level:

- While ETZO fostered the vertical concentration of companies, VAT, as required in all processes of production and distribution of goods, the greater the number of phases existing in the circuit of production and distribution, the greater the tax burden. Unlike what has been until now, the tax burden on the acquisition of investment assets can be deducted. This increase in revenue is due, on the one hand, to the fact that some of the products that until now did not pay are going to be taxed, on the other, to the increase of the rates for most products and, finally, to the need to establish strict controls to deal with the scam. However, it would not be wrong to remember something about this point: if you want to expand the collection, there is another tax: the estate tax, which taxes non-productive capital: On the other hand, it seems that this tax increase would go towards financing social security; the reduction of the corporate quota would be compensated by this tax. The latter relates to the reason for the third point. The reduction of the corporate social security quota reduces the cost of personnel and becomes an important factor for the promotion of employment. (Believe after seeing him).

Operational

VAT is the general consumption tax required for any business activity, that is, for the sale of goods or the provision of services. So, what you have to pay on the purchase and the tax that is charged on the sale.

Any company, professional or artist, in the provision of a service or in the delivery of goods, is obliged by law to pass invoice. The invoice must contain what is paid to the seller plus the corresponding VAT, as with the TUC. The same will happen when the customer issues the invoice, which must differentiate the amount of the invoice from the corresponding VAT.

Each quarter the VAT of the invoices must be distributed in two batteries. On the one hand payment to suppliers (and on imports customs payment) and on the other payment of customers. If the difference between the received and the paid were positive, that amount would be the one we would have to enter the Treasury, we do not have to keep the invoices, we have no choice but to pay the silence. However, try not to be hit, with the excuse that they are taking advantage of the situation of rising prices.

Traders, industrialists, professionals and artists in general do not have to put pesetas from their mobile to pay VAT. Their function is to charge their customers and thus recover what they have paid when making their purchases. Finance and consumption. On the contrary, if it were negative it would be a credit with Treasury and should be taken into account in the following month. If the negative difference came back in the following quarter, you would do so in the following quarter, and if at the end of the year you had a difference in your favor, you could ask Hacienda to return the money.

Yes! to credit these charges and payments it is absolutely necessary to save all invoices. Well, at least companies do, because they are simple intermediaries between consumers.

It is a tribute of a general nature, with two aspects: on the one hand, it taxes all professional or business operations carried out in the Spanish State (including imports), regardless of the economic sector (production, trade and services), and on the other, it applies in all phases of the processes of production and distribution of goods and services.

With the VAT, all those who until now paid for debit and luxury, and also pay retail traders and all professionals.

VAT problems

The problems posed by the application of this tax and, therefore, those that should be taken into account would be, among others, the prices, the crisis and the scam.

Prices tend to increase to the entry into force of this tax. Entrepreneurs see higher rates on supplier invoices, and regardless of the fact that the dues supported are deductible and, as with the TUB, taking as tax cost, apply unjustifiable increases to their products.

Ignoring the reference to price and cost functions, they take advantage of the excuse of higher rates to increase prices without economic reasons.

Some products that were previously exempt now have to pay VAT and this new tax burden raises the prices of these new products, which reduces the purchasing power of workers, demanding for purely logical reasons a salary increase, and this increase in cost, an increase in price.

As for prices, we have already heard many times that they will rise with the establishment of VAT. Although knowing the increase that the consumer price index will suffer is an invention game, you can guess by saying that this will happen. The Government and the International Monetary Fund have therefore affirmed that by the application of this tax this index should not grow, but, just in case, the Government has estimated in its forecasts that the increase that will occur for this reason will be between 1.5-2%. On the other hand, the price increase of the last month of January has been 3%. Following this path, think about how this year's inflation level will increase.

The price hike corroborates events in other EEA states. In fact, Italy, Denmark, Great Britain, etc. Final consumers suffered spectacular price increases when this tax was established.

In this sense, it is worth mentioning the case in which at the end of the 1970s the rate that would affect the cost of meat in the Spanish State was mentioned. This rate was not finally applied, but suspicion caused prices to increase and then not decrease.

As for the crisis, it can be said that if prices rise, demand decreases, so production and investment will tend to it.

It should be noted, on the other hand, that this tax favors business capitalization against the employment of labor, since the tax borne in the acquisition of equipment goods can be deducted in its entirety.

Finally, since the introduction of VAT poses a risk of fraud, to prevent the Treasury box from being reduced, extraordinary controls are being established.

Therefore, in short, VAT will also be applied on primary goods not taxed until now (including food), which means an increase in consumer price indices. The collection capacity of this tax can be extremely tempting for the State and the increase in the rates of this tax would not be uncommon. The unequal budget of Social Security, growing imbalance, is the easiest way to cover.

Types of feesThe D6 EEC attributes to each State the power to set the number and level of the fees for this tax. In the Spanish state three types have been selected, one general of 12%, another reduced of 6% and the third high of 33%. GENERAL 12%: It corresponds to most operations, that is, to all those goods that do not have a reduced or high rate, the rate of 12% has been applied. REDUCED 6%: This type applies to the following operations:

HIGH 33%: It corresponds to subsequent operations.

|

EXCEPTIONSThe following activities will not normally be subject to VAT:

|

Accounting notes

With the entry into force of VAT, companies have been imposed a series of obligations, including, in addition to the books required by the Commerce Code, when issuing and delivering invoices, the following:

- Customer invoice book

- Supplier Invoice Book

- Book record of investment assets

- Registration book for the liquidation of the tax corresponding to the collection of invoices

- Book record current accounts clients

- Book record of current accounts with suppliers.

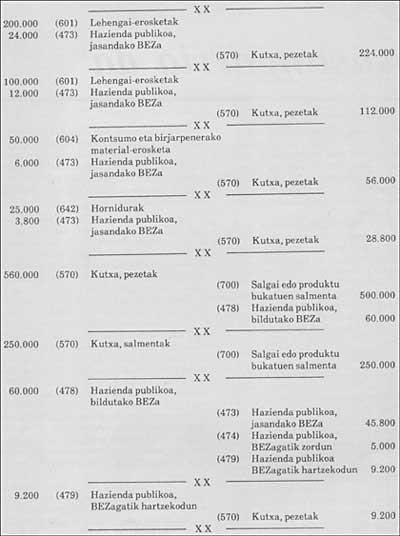

Due to VAT, the accounting of the company's relations with Treasury requires the creation of new accounts and, by default, the Accounting Planning Institute has given instructions. Therefore, in subgroup 47 of the General Accounting Plan, corresponding to Entities or Public Administrations, four new accounts appear:

(473)Public treasury, VAT supported

(474)Public treasury debtor by VAT

(478)Public treasury, VAT collected

(479)Public treasury creditor by VAT

We will see the movement of the following accounts following an example:

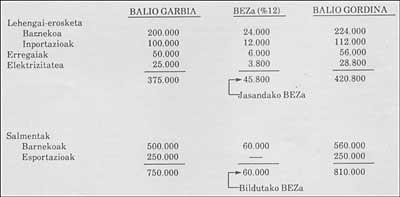

Suppose that at the beginning of this year in the accounting of the company Public Finance had a credit of 5,000 pesetas with the company, and that the operations carried out by the company in this exercise are the following:

It buys raw materials, 200,000 pesetas within the state and 100,000 pesetas out, 50,000 per fuel and 25,000 per electricity.

It has sold products in the State, 500,000 pesetas, and exported others.

All these values are VAT free.

Collecting the following operations in a table:

When making the seats corresponding to these operations would proceed as follows:

Gai honi buruzko eduki gehiago

Elhuyarrek garatutako teknologia