Monetary crisis: Maastricht is in the Netherlands

1992/11/01 Zurbano, Mikel Iturria: Elhuyar aldizkaria

If the title arouses some concern and encourages you to read these first lines, those of the beginning, you have little merit, that strong reader. In fact, the theme of European currencies is the one that burns more than what is to pil-pil.

Do we have so much European monetary crisis? Why have we reached this current monetary chicken coop? How far will the crisis come? And if it explodes, what are the alternatives? Too many questions, correct answers, when they are so scarce.

You will have noticed that we are talking about currency or currency. Despite its close link, no further mention has been made here in the economic sphere of the EVD and the Maastricht Treaty, unless its relationship with the current situation of money is analysed.

“The roots of this current crisis of the EVD are found in the German union. So far the European Union has maintained a fairly stable balance between Germany, France and the United Kingdom, drawing close to Italy. A generation ago, the GDP (Gross Domestic Product) of these three countries was similar. By the year 2000, German production will reach levels similar to those of France and the United Kingdom. Now Germany dominates Europe and is not a member of Europe, it is more than a member. Germany also has alternatives to the current Europe. The German framework is like the dollar of 30 years ago. In eastern Europe, Germany’s investment level exceeds half of the total external investment in this area.”

These words correspond to Romano Prodi, who for eight years was president of the Italian institute IRI (equivalent to the INI here) 1. Brutos and luminaires. It does not offer the slightest option to the doubt. However, another key factor in this monetary crisis has been the disparity of some countries between their real and financial economies, or what is the same, the autonomy of the sphere of the financial economy in the current capitalist economic systems, which has led to the hardest speculation.

Behind the European Monetary System

Remember that the Treaty of Rome, which created the EVE, was agreed at the time of the fastest economic growth in the history of capitalism. In this context, the priorities for addressing the path of economic unity were established in the agrarian and monetary spheres. We have six founding members – France, Italy, the Federal Republic of Germany, Belgium, the Netherlands and Luxembourg – six with developed and efficient production systems.

The trend towards the development of productive systems led to the idea that these six economic areas would have their own closeness. It was, therefore, to give priority to monetary convergence 3 and thus emerged first what is known as “monetary snake” and after the European Monetary System (EMS). By birth, the European Monetary Union (EMU) is the main strategic objective of the Association to achieve political and economic unity. The EMB access tools are currently the aforementioned EMS and Gambios Regulatory Mechanism (MDL).

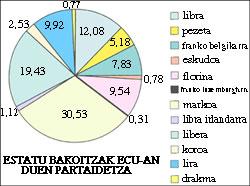

What does this acronym revolt consist of? In summary, EMS was created in 1979 replacing the “monetary snake” and establishing a new currency, the ECU. The ECU is a weighted basket formed by all EMS coins (see figure). In addition, currency exchange rates for all participating countries in EMS must be within a limited fluctuation margin with respect to the ECU: ±2.25 for all coins, except pound, stocks and peseta, with the latter range being ±6. Finally, through the WTO, each currency has a fixed exchange rate with respect to the ECU.

EMS Contradictions

The aim of EMS is to obtain a single sound coin plus the European Central Bank. To reach it, the absence of intermonetary fluctuation is necessary. However, EMS regulates in the same measure the fixation of the exchange rates of European currencies and the possibility of an unforeseen revision of their similarities. And this is the first contradiction, because the closer EMS is to its final goal, the faster the fluctuations will be, endangering the stability of EMS and moving away from RME. In other words, EMS has as its philosophy the liberalization of the monetary market, but it regulates the regulatory mechanism to correct the dysfunctions generated in this market.

On the other hand, there is the problem of the distance between the real or productive economy and the financial one. The commitment to maintaining a narrow margin with the ECU limits the capacity of national monetary policies and, therefore, their effectiveness, and increases the collapse of the productive system in the most depressed countries. The second contradiction is that of monetary unity, constructive dynamics in the face of the proximity between the real economies of the member countries (or the beginning of the house by the roof).

Stop of Maastricht EMS

In the history of EMS, instability and changes predominate. The trend that has been known since the beginning has been the constant strengthening of the frame and its assistant, the Dutch florin, and the devaluation of most of the coins throughout the 1980s.

In this situation, the peseta was introduced in EMS in 1989, imposing from the beginning a very high exchange rate of the peseta. The pound sterling and the Portuguese brush were then introduced. Thus, in 1991 the eleven EMS coins were in a serious balance, accelerating the speed of the train when it was ordered to get to Maastricht as soon as possible. Before 1995 it was necessary to arrive, without paying attention to a new recession of the economic crisis.

In this new phase the new conditions of Maastricht are established, with the aim of obtaining a single currency at the end of this decade and the European Central Bank (core and axis of this prestigious Treaty).

The design made in Maastricht to obtain a single coin summarizes the so-called “Delors Plan” of 1989. This foresees three phases. In a first phase, begun on July 1, 1990, a broad financial liberalization was established, leaving a free flow of capital and financial services at EVE 4. The second phase is scheduled for 1994, with the construction of the European Monetary Institute (EMI). The main function of this entity will be to group the statistical criteria for monetary analysis. The third phase, which will be launched between 1997 and 1999, will become the European Central Bank (ECB). The ECB will be governed by a board of directors composed of technicians appointed by the Member States. However, the relative autonomy of the ECB will be, for example, the final decision on exchange rates, which will be adopted by the EVD Council.

In order to participate in this monetary unit, it is essential to be within a process of economic approximation for state money. For this purpose there are five necessary requirements:

- The public deficit cannot exceed 3% of GDP.

- Public debt cannot exceed 60% of GDP.

- Inflation cannot exceed 1.5% of the average rate of the three States with lower rates.

- Bank interest rates may not exceed 2% of the average rate of States with lower interest rates.

- In the narrow interval of the monetary system (±2.5) the currency wishing to participate in the union must remain at least two years.

Remember that the first two conditions seriously define the capacity of action of national governments. The three and four force inflation to be controlled and the fifth seeks to guarantee monetary stability.

If all attempts to enter into force of the ECU have failed, it does not seem that the current one has a better chance. In fact, currently France, Luxembourg and Germany are the only countries that fully meet the five requirements. Italy, Portugal and Ireland do not meet any and the Spanish state only meets the second. Thus, most EMS economies should have a strong structural transformation to reach the monetary unit. The impossibility of this is foreseen in the Concert itself when it speaks of different rhythms of entry. Therefore, in addition to the only march towards unity, the diversity of rhythms is implicit in the Treaty itself. Moreover, the signing of the Treaty guaranteed the right of the United Kingdom and Denmark to leave this process of union.

Colloquium EMS

The Treaty, and in turn EMS, suffered a major revolt on the outcome of the Danish referendum and the doubts raised at the entrance and after France have questioned the System. The rest has been carried out by the speculative activity of the framework. Why this German behavior? The reason is simple: Germany has little interest in promoting the ECU and the European Central Bank. By eliminating the framework and approving the coordination of economic policies, he knows that the German government will lose much of its current economic capacity. It is difficult for Germany to recognize it in the face of the economic crisis and the situation of the Eastern Landmines. In addition, again, Germany has another possible alternative for its economic project: Eastern Europe.

Germany, by increasing in July the interest rates to deal with the costs of economic reconstruction in East Germany, and by increasing the strength of the framework, knew that this measure would affect the EMB process. However, it did not go back, although then there was a slight devaluation of the frame to calm tensions.

The following are the events that have led to results that we all know: the lyre and the pound sterling are today outside the EMS, they have had to devalue the peseta and the German Central Bank –Bundesbank– has had to intervene so that the pound does not devalue. The removal of Libra EMS seems at least definitive in the medium term. Lira also does not seem to be in a hurry to return and the peseta is bankrupt.

Inability of the peseta

Will devaluation be so dramatic? In principle no. It has immediate and negative economic effects. The worst consequences are the increase in the price of imported goods (for example, that of fuels, which must be paid in dollars), the increase in inflation (the Consumer Price Index for devaluation of the peseta will increase by 0.3%) and the increase in the external debt. However, it also has its advantages: increase exports, increase tourism and discourage speculation.

In the context of this devaluation of the peseta, the greatest difficulty of the Spanish monetary authorities is to prevent the performance of monetary speculators. Speculators (banks, financial institutions or individuals) use a single mechanism to appropriate the intense yields, knowing the monetary system and, therefore, avoiding risk: to sell a weak currency against a possible devaluation; thus, when the devaluation occurs, they buy it again but at a lower price. With this simple operation, round businesses are carried out.

What does the government do to hinder this performance? Devaluing the currency, raising interest rates (with the risk of increasing the recession), intervening the Central Bank by buying pesetas instead of foreign currencies (reducing the currencies to feed the short-term solution), the main route used by the Bank of Spain. Optionally, there is also a control over foreign currency funds, a measure established by the Banco de España on 24 September. The latter is contrary to the liberalizing philosophy that EMS has and leads us to the essence of the first contradiction.

Attractive areas for speculation are territories with weak currencies. But how is vulnerability measured? It is not a specific arithmetic relationship, but we know that the farther away from the specific international weight of the productive economy on which the currency is based, the currency exchange rate of a currency is easier for speculators to stock monetary benefits. This is why speculative trends mainly choose lira, pound, and peseta.

Overvaluation of the peseta

In Spain, with the PSOE's monetary economic policy, interest rates have been high in recent times. With the excuse of reducing inflation and respecting the fixed exchange rate of EMS, the money has been cared for, and the demand for loans from agricultural, industrial and service companies has fallen below productive investment. This trend is also reinforced by the decapitalization of the productive field towards the financial sector.

The other result of high interest rates has been the low growth of external capitals of the last decade. Thus, the productive economy did not show the dynamics, but the external attraction of capital has given the peseta the aspect of force. Although this situation is constant in recent years, this year the economic indicators have worsened. For example, at the beginning of this year the public deficit target is 1.5% over GDP, and the real one will rise to 6% at the end of the year. Likewise, the current account balance deficit will reach 5%, compared to 2.5% last year.

It has been enough for Germany to raise interest rates to turn it into ashes into a solid construction. Speculators have highlighted the overvaluation of the peseta, it is indifferent! Therefore, the priority of the economic policy of the PSOE, that is, the desire to maintain the fixed exchange rate by disregarding the behavior of the public sector through interest rates, has increased the stagnation of the productive system while the imports were being driven. The result of this economic policy is the shortage of incentives for the productive entrepreneur, the small industrial fabric, the fragile foreign sector that announces a slow future growth and a bankrupt public sector.

Maastricht is not in the Alentejo

Although it contributes to the operation of the European Internal Market, the monetary unit is not obligatory for this purpose. However, this goal is conditioning and seriously making economic unity. The problem of this path is that it is not possible without taking steps towards the economic convergence of countries committed to unity, as has now been seen. The storm will be there as long as the budget and fiscal harmonization are not produced. In the coordinates sent by Maastricht the unit will be exclusively nominal and will not affect other economic factors such as productivity, unemployment or growth.

With regard to the Spanish state, integration in the Europe of France and Germany requires, at least, a new orientation of economic policy, a balance in the productive system and a competitiveness of the foreign sector. That is to say, to deal with the real problems of the economy and not to sustain the financial tricks that are undone from top to bottom when speculators appropriate the crudeness of deception. If not, the attempts that are being made to avoid the second devaluation will be useless, and to make statements as bold as those of the entry into Europe of first speed.

- El País, September 20, 1992.

- The sinking of Italy is very recent; until the mid-eighties it knew the highest productive growth of the Economic Society, despite the crisis.

- The Common Agrarian Policy was also promoted, taking into account the concrete situation of the primary sector.

- In the Spanish state this year this phase has begun.

Gai honi buruzko eduki gehiago

Elhuyarrek garatutako teknologia